The walls are closing in on US-based billionaire Julius Mwale as a fresh court battle exposes a carefully cultivated image of success that is beginning to crumble under the weight of unpaid bills, bounced cheques, and a growing list of contractors demanding their money.

In a dramatic turn that has set tongues wagging in legal circles, Mwale now stands accused of shifting blame onto a deceased contractor in a desperate bid to escape a Sh17 million debt judgment, even as multiple creditors across two continents sharpen their knives for what could become one of Kenya’s most spectacular business collapses.

The entrepreneur, who has spent years rubbing shoulders with African presidents and Hollywood celebrities while promoting his Sh200 billion Mwale Medical and Technology City in Kakamega, is facing a moment of reckoning that threatens to expose the precarious foundations of his empire.

A Pattern Emerges

Court documents and investigations spanning 15 years paint a disturbing picture of a businessman who has left a trail of unpaid contractors, bounced cheques, and broken promises stretching from New York to Nairobi. The total unpaid bills, according to court records in Kenya and the United States, exceed Sh325 million.

The latest controversy involves Sifatronix Limited, a company that claims it supplied murram worth Sh17 million for road construction at Mwale’s flagship project in 2017 but was never paid.

When Sifatronix sued, Mwale’s defense hinged on testimony from the late Dr. Fitzgerald Oketch, who swore an affidavit stating that his company, Epic Agencies, had the contract with Tumaz, not Sifatronix.

Dr. Oketch died unexpectedly in October 2025, just before a crucial court hearing. With the primary witness now silent in death, questions are being raised about whether Mwale’s legal strategy amounts to throwing a dead man under the bus to escape liability.

Justice Freda Mugambi ruled against Mwale in February 2025, piercing the corporate veil to hold him personally liable alongside his company, Tumaz and Tumaz Limited. The businessman is now appealing, but the case has reopened old wounds and drawn fresh scrutiny to his business dealings.

The Kakamega Contractors Speak Out

Sifatronix is far from alone. Multiple contractors, suppliers, traders, and vendors who worked on the Mwale Medical and Technology City project have come forward with similar stories of unpaid bills and broken promises.

Some claim they have been physically prevented from accessing the facility to demand payment. Others say they received only promissory notes that were never honored. Bloggers, content creators, and models hired through a South African agency to promote the project were never paid a dime, with several removing their promotional material in disgust.

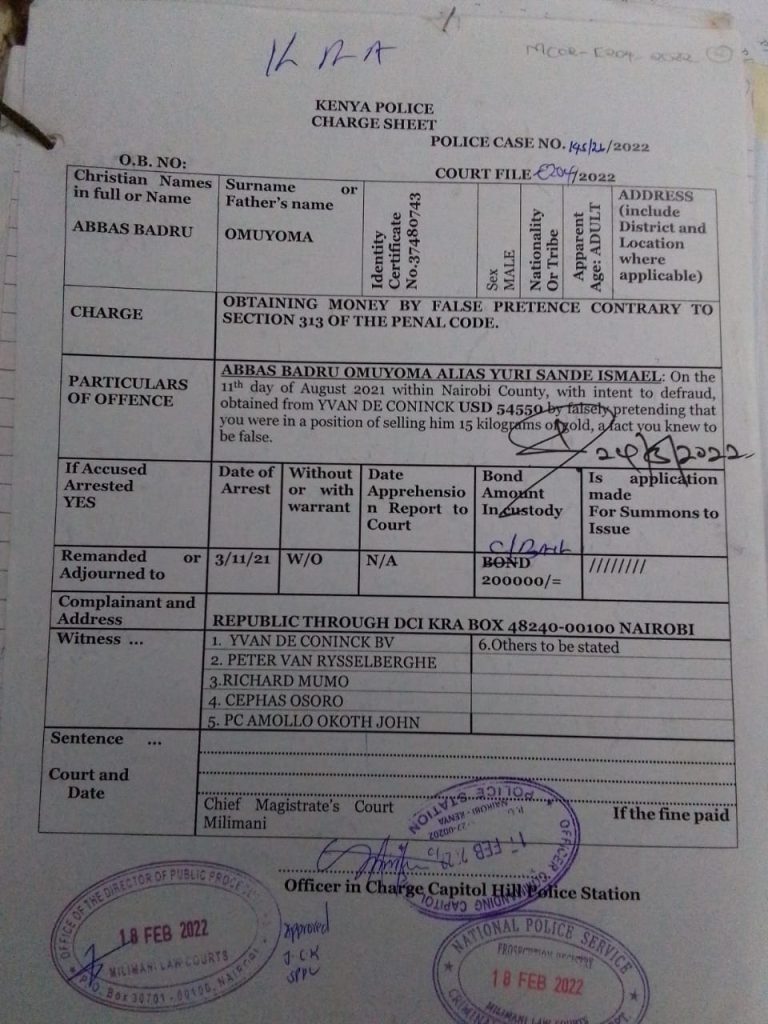

In 2018, Mwale was accused of issuing bad cheques to contractors amounting to Sh22 million. Court documents from that period show him seeking to stop police from arresting him over allegations of bounced cheques. He claimed his lawyers had compelled him to write post-dated cheques even after disputing the amounts demanded by contractors.

The scale of the problem became clearer when local residents began speaking out. Many claim they lost large tracts of ancestral land to Mwale after he made empty promises to build residential and rental homes for them. What was once promoted as a “village paradise” and Kenya’s answer to Silicon Valley now stands as a monument to unfulfilled dreams.

The American Debts

Mwale’s troubles are not confined to Kenya. In the United States, where he has long presented himself as a self-made billionaire, a very different picture emerges from court records.

In August 2025, a California court evicted Mwale and his family from a multimillion-dollar estate in Alamo after he failed to pay rent and issued a Sh58 million cheque that bounced. The property, which Mwale had for years presented as his own and even “gifted” parts of to influential figures, was actually a rental. When payments stopped in October 2024, the landlord moved to evict.

Court filings revealed that the lease arrangement not only covered the residence but also included two luxury vehicles, a Bentley and a Mercedes, which Mwale frequently showcased in photographs as symbols of his financial success. The cars, like the house, were not his.

Perhaps most troubling is the case of Fiona Graham, a 95-year-old blind and partially deaf psychiatrist who claims Mwale defrauded her of Sh466 million. Court documents filed in New York Supreme Court in 2019 reveal how Mwale first met Graham when he arrived at her clinic wearing threadbare shoes, having walked from a men’s shelter.

Graham says Mwale befriended her under false pretenses, eventually coercing her into remortgaging her properties to lend him money. Despite signing a promissory note in 2019 agreeing to repay Sh466 million by November 2020, with eight percent annual interest, Mwale has reportedly failed to honor the debt. As of February 2024, Graham was owed Sh466 million in principal plus Sh176 million in accumulated interest.

The Shaw Saga

In 2024, American couple Mathew and Brooke Shaw sued Mwale and his wife Kaila for Sh220 million, claiming they were lured into investing in fraudulent projects. The Shaws said they met the Mwales at a private dinner in Utah in February 2022, where the couple presented themselves as billionaires with connections to powerful figures.

Court documents detail how Mwale shared text messages and recordings of alleged private video calls with prominent Americans, including Senator Mitt Romney and US Ambassador to Kenya Meg Whitman, to enhance his credibility. The Shaws were invited to what they believed was the Mwales’ estate in San Jose, California, where they were shown expensive automobiles and a wine cellar reportedly valued at Sh32.5 billion.

The American couple claim they invested Sh220 million in projects including geological surveys in the Democratic Republic of Congo for a battery manufacturing plant. When they visited Kenya in August 2022 to inspect their investments, they discovered the reality was vastly different from the promises.

The hospital Mwale claimed was the world’s largest and most advanced with 5,000 beds turned out to be largely incomplete, with only one wing operational, functioning primarily as a basic clinic treating local children for malaria. The promised golf course was far from complete, and the rental homes built for farmers were described as little more than vacant concrete boxes with no facilities.

The Shaws eventually withdrew their lawsuit in May 2025 after a settlement was reached, but only after the case had been transferred between courts in Utah and New York. The withdrawal was done “without prejudice,” meaning they retain the right to refile in the future.

Earlier Warning Signs

Mwale’s troubles in America date back much further. In 2009 and 2010, his company SBA Technologies was sued in New York for failing to pay rent for its headquarters on Fifth Avenue. By 2015, the unpaid rent and interest charges totaled Sh27 million.

In 2010, two co-directors of an addiction treatment center filed a complaint claiming they were deceived into investing Sh34 million in SBA Technologies. They said Mwale told them their investment would increase more than 30-fold to Sh1.1 billion if the company was listed on the stock exchange. The company was never listed and was dissolved in 2010, though it was later revived.

Mwale has also faced questions about his credentials. While he claims to have studied at Columbia University, a university spokesperson confirmed he attended in 2004 but did not receive a degree. The Kenya Defence Forces dismissed his claims of being a qualified radar technician or aeronautical engineer, stating he was fired for being absent without leave in 1999.

The Kakamega County Battles

Back in Kenya, Mwale’s relationship with local authorities has been rocky from the start. In 2017, Kakamega County Government threatened to demolish the Mwale Medical and Technology City project, claiming the investor violated multiple laws including the Physical Planning Act, Public Health Act on Housing and Sanitation, County Government Act, and County Land Registration Act.

The county argued that Mwale never received proper clearance to undertake the development. He went to court and obtained orders blocking the demolition, but the legal battles strained relations with local authorities.

Despite these troubles, Mwale has continued to announce ambitious expansion plans. He has claimed partnerships to build similar medical cities in Botswana, Ghana, the Republic of Congo, Sierra Leone, and the Democratic Republic of Congo. However, investigations have found that many of the companies cited as partners on MMTC’s social media pages have not actually invested.

The Media Campaign

Throughout these controversies, Mwale has maintained an aggressive media campaign. In the early years of the Kakamega project, mainstream media carried glowing articles describing it as a “game changer” that would transform western Kenya. The project was compared to Silicon Valley and promoted as Kenya’s gateway to becoming a technology hub.

Celebrity endorsements added glamour to the project. Italian influencer Elisa De Panicis, an ex-girlfriend of Portuguese football star Cristiano Ronaldo, visited the medical facility and reportedly enrolled more than 300 family members in a National Hospital Insurance Fund scheme that was fully sponsored.

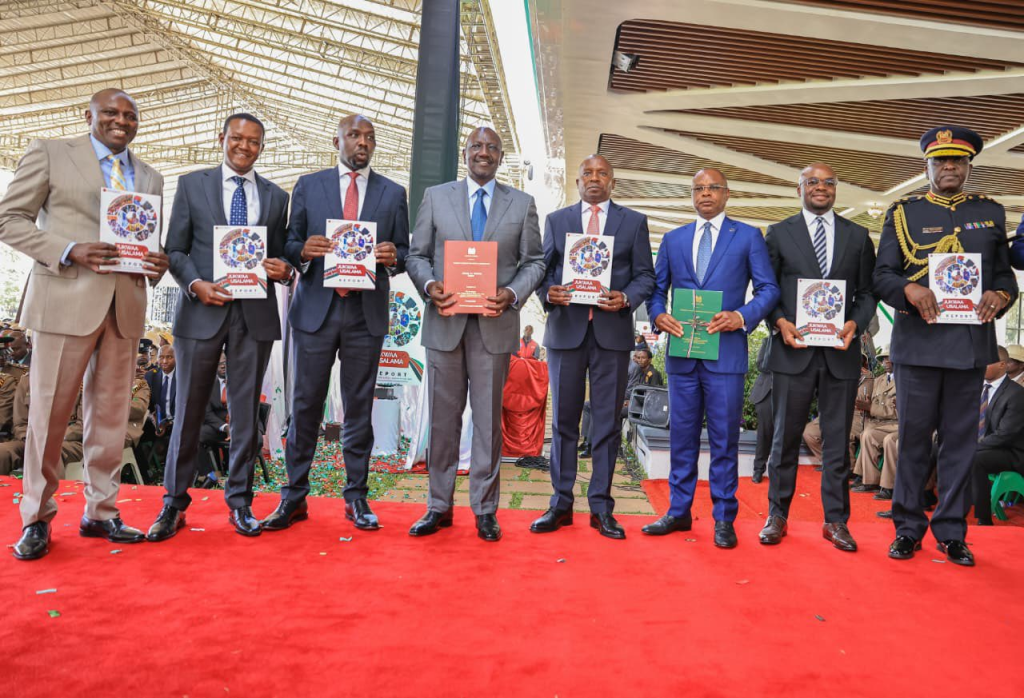

High-profile events were organized, including the 2013 Forbes Billionaires Symposium in New York, sponsored by SBA Technologies. Guests included presidents from Congo, Mozambique, Kenya, and Ghana. The glitz and glamour created an aura of legitimacy around Mwale’s ventures.

However, seven years after the project started, the media attention has largely dried up. Many of the early promotional stories have been quietly suppressed as the reality on the ground fails to match the promises.

The Current Crisis

The Sifatronix case has become a flashpoint because it exposes vulnerabilities in Mwale’s business model. The High Court’s decision to pierce the corporate veil and hold him personally liable sets a dangerous precedent for his other ventures. If other creditors follow suit and succeed in holding Mwale personally accountable, the consequences could be catastrophic.

His defense strategy of relying on testimony from the now-deceased Dr. Oketch has been criticized as opportunistic. Legal observers note that with Oketch unable to be cross-examined or provide additional context, Mwale is effectively using a dead man’s words as a shield while avoiding accountability.

The case has also become entangled in a broader controversy involving his lawyer, Senior Counsel Nelson Havi, and the Judiciary. Havi has been waging a public campaign alleging corruption among judges, claims the Judiciary has vehemently denied. Havi says he was sanctioned by Justice Mugambi in October 2025 for his outspoken criticism, raising questions about whether the judgment against Mwale is connected to this feud.

As Mwale’s appeal proceeds to the Court of Appeal, the stakes could not be higher. A loss would not only confirm his personal liability in this case but could embolden other creditors to pursue similar claims. The precedent could unravel the corporate protections that have so far shielded him from the full weight of his debts.

Multiple sources familiar with his operations suggest that other creditors are watching the case closely. If the appeal fails, it could trigger a cascade of lawsuits that would finally bring Mwale’s empire crashing down.

For now, the entrepreneur remains defiant, continuing to market his vision of transforming Africa through technology and healthcare. But as the unpaid bills pile up and the legal battles multiply, questions are growing louder about whether Julius Mwale is a visionary entrepreneur or simply a man who has mastered the art of staying one step ahead of his creditors.

The contractor’s widow may never see justice for her late husband’s work. The blind 95-year-old psychiatrist may never recover her life savings. The American investors may never recoup their millions. And the Kakamega contractors may continue to wait in vain for payment.

In throwing a dead contractor under the bus to escape his debts, Julius Mwale may have finally gone too far. The court of public opinion has already reached its verdict. Now it remains to be seen whether the Court of Appeal will agree.

A representative for Mwale declined to comment, citing ongoing court proceedings. But his silence speaks volumes as the walls close in on a man who once promised to build cities but may end up buried under the rubble of his own making.