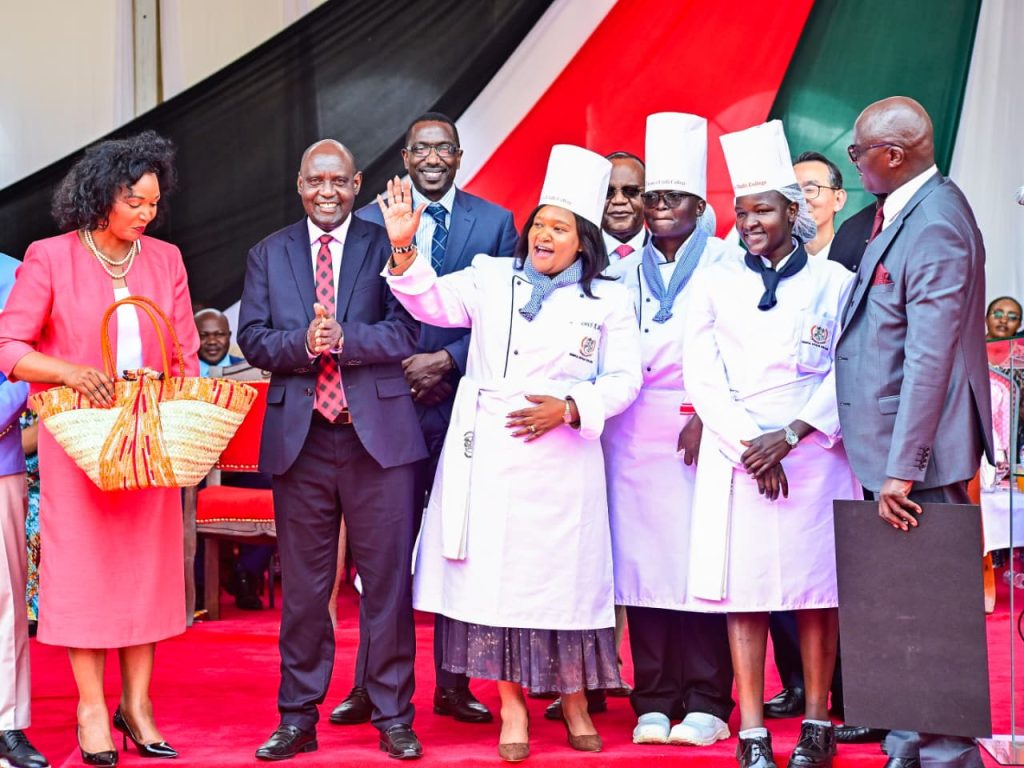

Kenya is set to significantly strengthen its position as Africa’s leading destination for global conferences and exhibitions with the fast-approaching completion of the Bomas International Convention Complex (BICC), Cabinet Secretary for Tourism and Wildlife Rebecca Miano has said.

CS Miano noted that the flagship project will play a critical role in advancing Kenya’s Meetings, Incentives, Conferences, and Exhibitions (MICE) sector, positioning the country as a competitive and preferred hub for high-level international events. She described the BICC as a strategic investment that will elevate Kenya’s capacity to host large-scale global summits and exhibitions.

Once completed, the BICC will have a seating capacity of 11,000, making it one of the largest and most modern convention facilities on the African continent. The complex is designed to host international summits, regional conferences, trade exhibitions and cultural events, reinforcing Kenya’s ambition to reclaim its status as Africa’s top destination for global meetings.

Speaking on the project’s progress, CS Miano said the Bomas International Convention Complex goes beyond infrastructure development and represents a deliberate effort to strengthen the tourism value chain.

“The BICC will be a crown jewel of our MICE offering. It will position Kenya competitively on the global stage while opening up new opportunities for growth across tourism, hospitality, transport, trade and the creative industries,” she said.

She added that the complex will offer a unique experience by combining world-class conferencing facilities with Kenya’s rich cultural heritage. Delegates and visitors are expected to enjoy authentic cultural experiences while conducting business at the highest level.

Strategically located in Nairobi — the “Green City in the Sun” and Africa’s diplomatic capital — the BICC is expected to further enhance the city’s attractiveness to international organizations and global forums.

According to CS Miano, the economic impact of the project will be far-reaching. By attracting major international events, the BICC is expected to increase visitor arrivals, boost hotel occupancy rates and stimulate demand for transport and logistics services. The project will also create opportunities for local suppliers, small and medium-sized enterprises and creative industries, while generating thousands of direct and indirect jobs.

CS Miano attributed the progress of the Bomas project to the leadership of His Excellency President William Ruto and the collective support of government institutions and stakeholders. She emphasized that the project aligns with the government’s broader agenda of positioning tourism and business events as key pillars of national economic development.

As Kenya prepares to welcome the world, CS Miano said the Bomas International Convention Complex stands as a symbol of confidence, ambition, and readiness, reaffirming the country’s commitment to hosting global conversations and showcasing its cultural identity on a world-class platform.