itel has rolled out an exciting new consumer rewards campaign dubbed “Shinda Mimili na itel”, giving customers across the country a chance to win cash awards totaling to Ksh 1.2Million and a variety of amazing gifts.

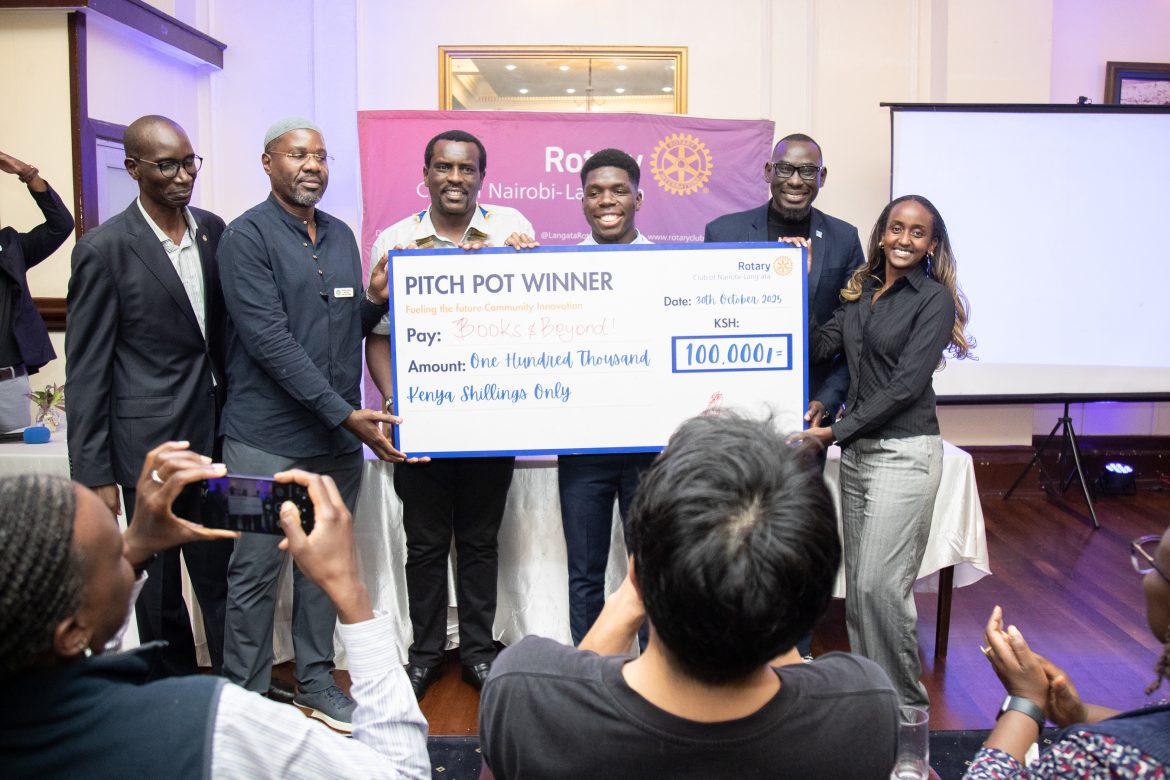

The campaign is designed to appreciate loyal customers while encouraging more Kenyans to experience itel’s latest range of smart devices and celebrate their unwavering loyalty and love for the brand over the years and two winners have been awarded each Ksh 200,000.

As part of the promotion, customers who purchase any of the following newly launched models from recommended retail outlets nationwide automatically qualify to enter the weekly draws:

- itel Super 26 Ultra (256 + 8) RRP is Ksh 20,499

- itel Super 26 Ultra RRP is Ksh 19,500

- itel A90 RRP is Ksh 9,999

- itel City 100 (128+ 6) RRP is Ksh 11,199

- itel City 100 ( 256 + 4) RRP is Ksh 11,800

- itel itel QLED Smart TV L4360N RRP is Ksh 16,099

- itel itel QLED Smart TV L3260KN RRP is Ksh 9,999

Upon purchasing any of these devices, customers receive a raffle ticket, which they are required to fill out with their details. This ticket becomes their entry into the lucky draw, giving them a chance to walk away with exciting prizes — including cash awards and other surprise gifts.

To build more engagement and transparency, itel will be hosting its raffle draws live on TikTok every Tuesday. Customers and fans can tune in to the official itel TikTok channel to watch the draws in real time, celebrate winners, and keep up with the latest campaign highlights.

The “Shinda Mimili na itel” campaign reflects itel’s commitment to offering quality, affordable devices while giving back to its growing community of users. With accessible price points and the added thrill of weekly wins, the promotion has quickly captured attention across the country.Offer ends on 22nd December 2025.

Customers are encouraged to purchase their devices from authorized itel retail outlets, fill in their raffle tickets correctly, and stay tuned to the weekly TikTok Live sessions for a chance to be among the lucky winners.