The High Court has suspended the move by Equity Bank to place investment firm Transcentury PLC under receivership.

The basis for the injunction stems from allegations that Equity Bank unlawfully appointed a receiver while negotiations were ongoing, constituting a flagrant breach of legal procedures.

The court-issued injunction effectively halts the appointment of the receivers and restricts them or their agents from taking any actions in their capacity as receivers of the company.

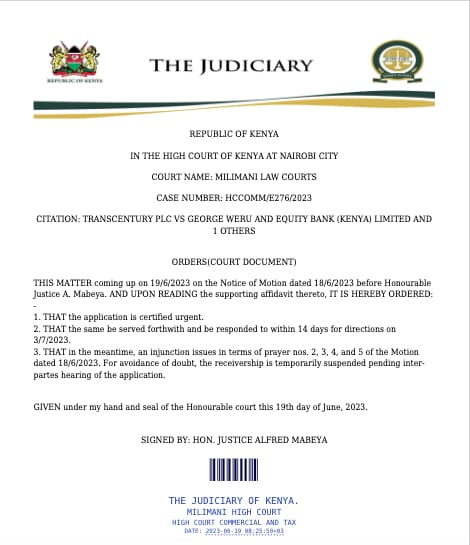

The injunction, issued by Honourable Justice A. Mabeya on June 19, 2023, comes in response to a notice dated June 16, 2023, which Equity Bank had issued to TransCentury PLC.

Transcentury and its subsidiary, East African Cables were placed under receivership over a Sh3.01 billion-shilling loan facility advanced by Equity Bank Kenya Limited.

The court deemed the application urgent and ordered that it be served promptly with a response required within 14 days, leading to a hearing on July 3, 2023.

“For avoidance of doubt, the receivership is temporarily suspended pending inter partes hearing of the application.”

TransCentury PLC expressed its satisfaction with the court’s decision, highlighting the irregularity that tainted the entire process.

“We are delighted to see that the court has recognized the irregularity that marred this very unfortunate and ill-intended process. We considered the bank as a partner and were engaged in what we believed to be positive discussions to reach an amicable agreement, just one day before the receiver was appointed by the bank,” stated Shaka Kariuki, Chairman of TC Group, upon releasing the injunction announcement.

“TransCentury is a significant business in Kenya’s economic landscape, we are committed to meeting our obligation, and hence the reason why we embarked on a Rights Issue transaction at the beginning of the year. Despite the challenging economic environment that Kenya and the world at large faces, we raised money from our shareholders and were preparing to settle on an agreement favourable to the business and the bank.”

The court-issued injunction effectively halts the appointment of the receivers and restricts them or their agents from taking any actions in their capacity as receivers of the company.

This development allows TransCentury PLC to refocus on its business operations and pursue its strategic objectives.

Nganga Njiinu, CEO of TransCentury Group, expressed confidence in the company’s resilient team and their ability to recover the lost time.

Njiinu emphasized their commitment to their mandate of making a transformative impact on Africa’s infrastructure.

“TC Group is steered by a very resilient team and I am confident that we shall recover the time lost as we continue focusing on our mandate of impacting Africa with transformative infrastructure,” Njiinu said.

The company’s Boards extend their gratitude to shareholders, staff, and partners for their unwavering support as they strive to steer the business towards growth.

As the court proceedings progress, stakeholders eagerly await further developments in this case, which holds significant implications for both TransCentury PLC and Equity Bank.