The Teachers Service Commission (TSC) has called upon Equity Bank to promote financial literacy among teachers and also enhance Kenya’s saving culture.

This initiative will include training for newly recruited teachers, equipping them with the skills to manage their incomes effectively and in turn instill saving habits in students from an early age.

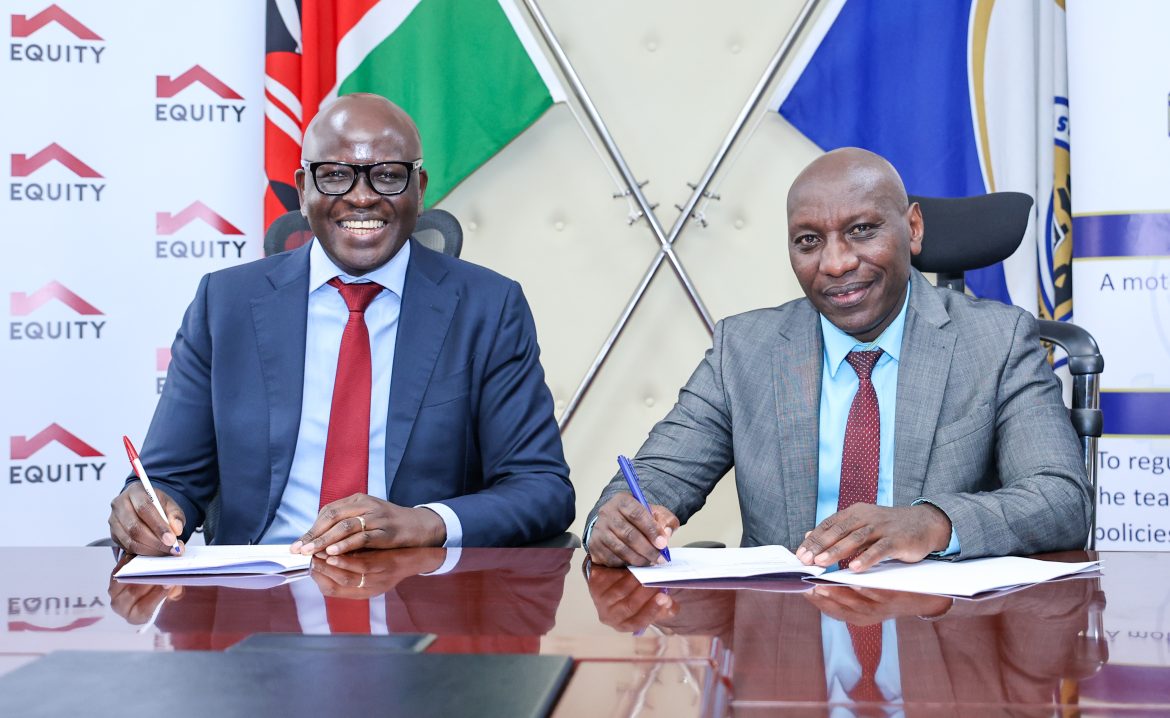

Speaking at the TSC head office in Upperhill, Nairobi, TSC Chairman Dr. Jamleck Muturi said the programme will start with teachers joining TSC in January. Dr. Muturi also received a Ksh10 million donation from Equity Bank Kenya Managing Director Moses Nyabanda in support of the World Teachers Day celebration, held on Sunday, 5th October 2025.

“We are proud to stand with you as teachers, and today we are here to commit with resources to walk with you. Through our 220 branches countrywide, we will provide the opportunity to walk with them as they settle in their communities. We have the network. Tuko kwa ground, and we will be there to do whatever is necessary,” said Nyabanda as he presented the cheque to the TSC Chairman.

The Managing Director congratulated TSC for making World Teachers Day a significant celebration of the achievements of teachers, who have imparted essential skills to pupils and students, making Kenya stand out in Africa.

“In Kenya, we recognize various other achievers but sometimes fail to celebrate the real heroes of Kenyan society—the teacher, who is the true hero. Teachers have made us who we are. Equity set out not just to bank teachers but to transform their lives, from not just being a teacher but becoming an entrepreneur also, and the multiplier effect that follows creates wealth,” he added.

Dr. Muturi further highlighted the vital role teachers play in shaping professionals, stating, “A teacher is like a candle that consumes itself to provide light to everyone in the process. No doctors, engineers, lawyers, or architects have not passed through the hands of a teacher.”

TSC Director for Administrative Services, Ibrahim Mumin, also expressed gratitude to Equity Bank for its support in celebrating teachers. He noted that the bank is a leader in the financial services industry, serving over 90,000 teachers.

“Thank you for giving all these teachers a shoulder to lean on,” said Mumin.