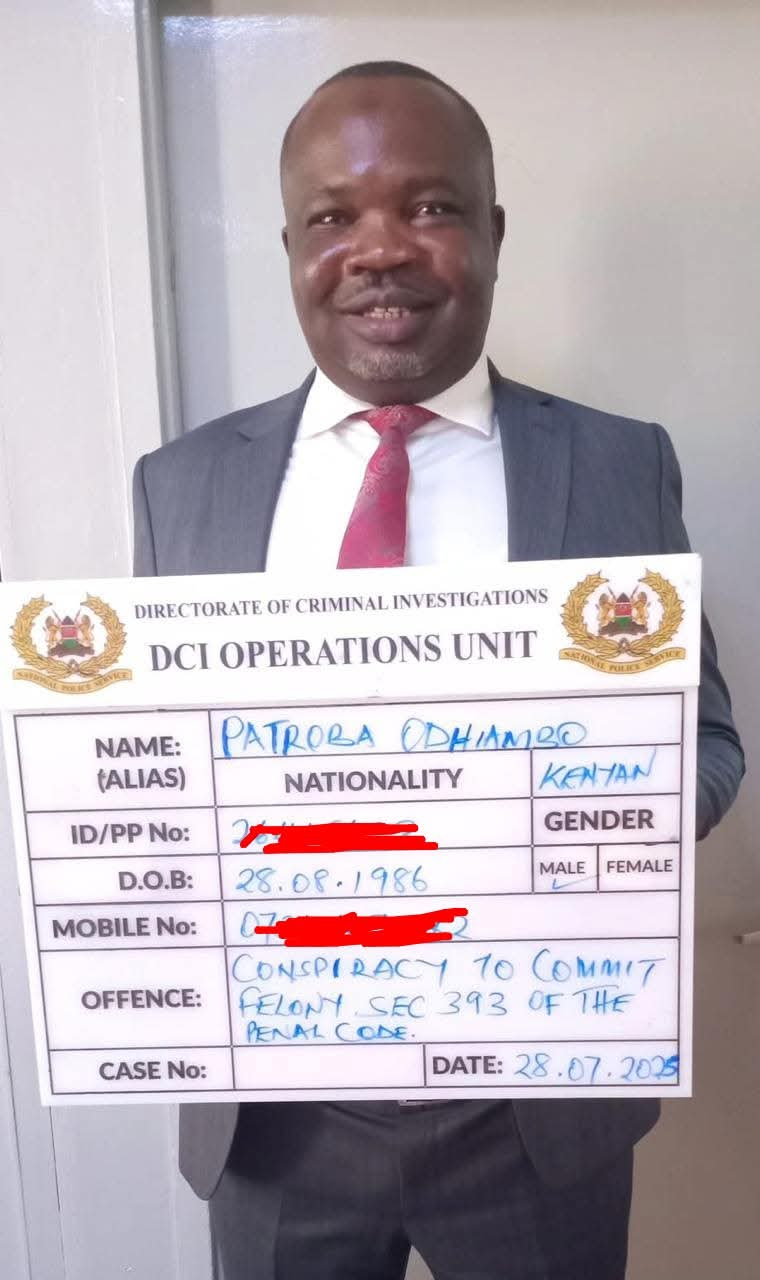

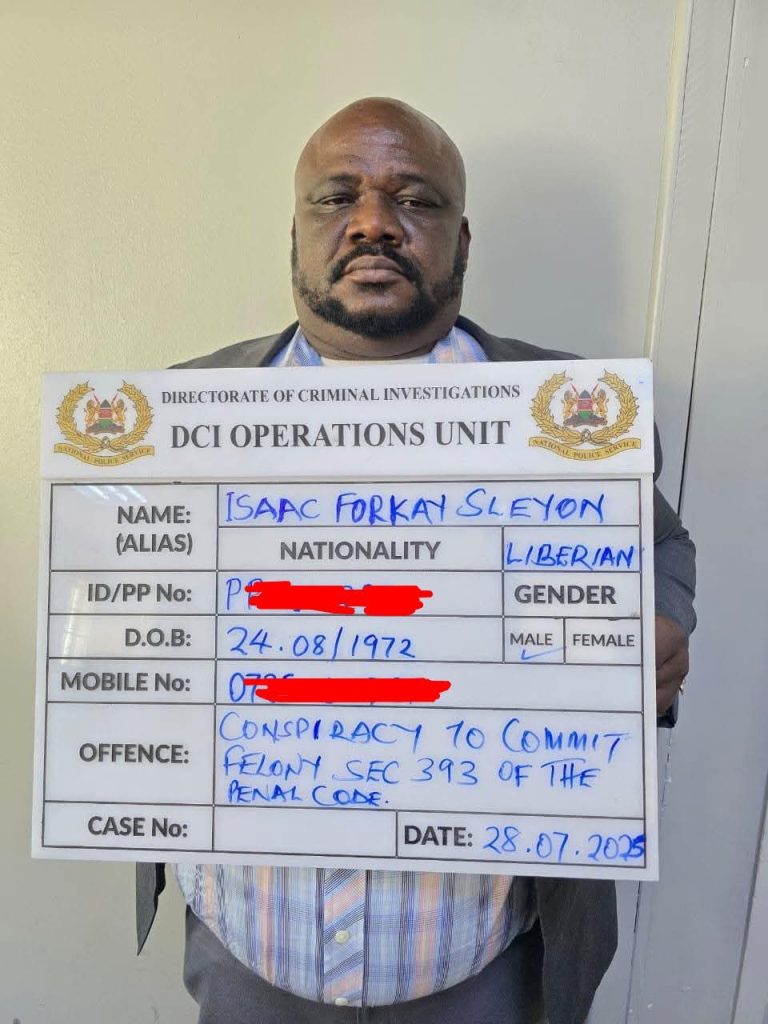

The Directorate of Criminal Investigations (DCI) has intensified its efforts against transnational gold fraud syndicates, responsible for defrauding foreign investors of hundreds of thousands of dollars through elaborate fake gold schemes.

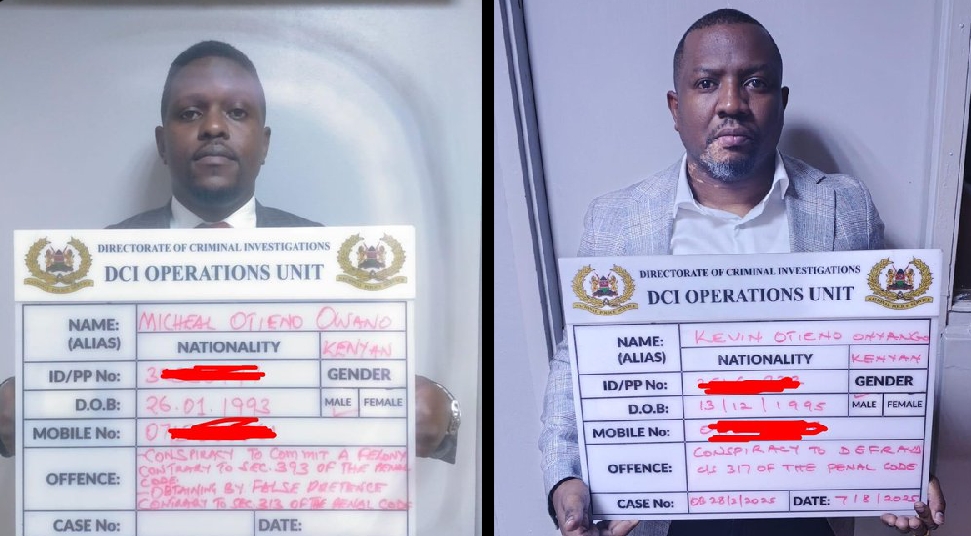

In an ongoing investigation, detectives from the Operations Support Unit (OSU) have arrested Michael Otieno Owano, an advocate and proprietor of Otieno M.O. Law Advocates, for his role in a high-stakes scam that defrauded a Canadian investor of USD 618,000.

The victim was lured into a fake gold export deal involving 250 kilograms of gold, allegedly set for shipment to Dubai aboard a private jet. On April 15, 2025, a Proforma Invoice of USD 318,400 was issued by EAI Logistics, with the funds wired to Owano’s law firm account. He was later asked to send an additional USDT 300,000 to a cryptocurrency wallet, but no gold was ever delivered.

Owano’s arrest follows the earlier arrest of Francis Talla Ouafo, also known as Allain, a Cameroonian national believed to be the mastermind of the syndicate. He was arraigned on July 31, 2025, at the Milimani Chief Magistrate’s Court.

In a separate but similarly orchestrated scam, Lupemba Lorenzi Olivier, a Congolese national, appeared at the Milimani Law Courts in connection with a fraudulent gold deal targeting a Gabonese investor. Detectives secured a seven-day custodial order to finalise investigations. The matter is scheduled for mention on August 13, 2025.

Meanwhile, another suspect, Kelvin Otieno Onyango, alias Kevo Sonko, the alleged director of SwiftTaxis Logistics Ltd, was arrested for his role in the same case. The complainant was led to his office, where they negotiated and formalised the gold deal. He later transferred USD 140,000 into an escrow account.

All the suspects are currently in custody, undergoing processing pending their arraignment in court, as DCI intensifies efforts to dismantle the networks behind these sophisticated gold scams.